Greetings from Motown!

First, thank you to everyone who signed up to get the High Speed Rodeo via email - more than 100 readers in the first week! I appreciate your readership, and I hope you will share the High Speed Rodeo and the signup link with others.

I will keep sending the newsletter for free to everyone who signs up. But if you want to support my independent work, please hit the “Upgrade to paid” button below. Paid subscribers will get extras beyond the weekly letter, depending on the news.

So…It has been a rough week in the World of Cars.

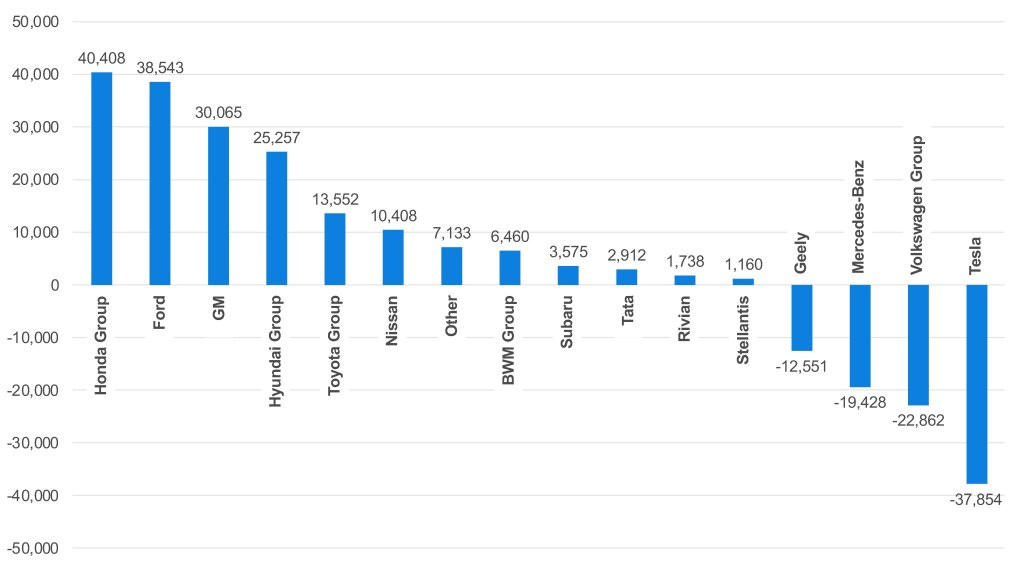

This edition of HSR could focus exclusively on the dour sales reports from Volkswagen, Mercedes, BMW, Audi and Porsche. How long can the legacy automakers of Europe and Detroit go on losing sales without shutting more factories and slashing more jobs?

Not long, according to a new report from Gartner.

Good news for suffering Western incumbents: Ever bullish Chinese EV companies (and government officials) might want to buy your surplus factories.

How would that solve the Chinese auto sector’s mind-bending overcapacity problem? Great question.

So there’s no shortage of topics, but today let’s look ahead to what will be an important round of financial reports from the world’s automakers starting later this month with Tesla’s event, scheduled for Jan. 29 at 4:30 PM Central U.S. Time.

Who knows what Elon Musk will say - assuming he attends the call (from time to time he has suggested he is bored by the ritual.)

Here are some questions analysts could ask, based on the hurly-burly surrounding the World’s Busiest Man:

1 - How does all the time spent working with the Trump administration help Tesla shareholders?

Whatever you call Musk’s role with the incoming administration, it is consuming time and attention. Figuring out how to cut $2 trillion from federal spending would be a full-time job for most people. Musk is also stirring up trouble in British and German politics, beefing with prominent members of Trump’s base and, maybe, entertaining a proposal from the Chinese government to buy TikTok.

No doubt I forgot something. You get the idea.

Will Musk’s days in Mar-a-Lago translate to policy and regulatory decisions favorable to Tesla? Trump’s nominee for Transportation Secretary (overseeing federal vehicle safety regulators) says no. Rival automakers say they’re not worried.

Well then, what’s the point? Trump could see that the latest SEC charges against Musk go away is not an answer for Tesla shareholders.

Meanwhile, who’s running Tesla while all this is going on? Which brings us to…

2-How will Tesla avoid GM disease?

(Source: Cox Automotive/Kelley Blue Book)

Electric vehicle sales are growing globally - including in the United States! Get the full KBB U.S. electric vehicle sales report here.

Demand for Tesla EVs is not.

Musk’s stainless steel, slab-sided, cinderblock baby, the Cybertruck, looks like a Cyberstiff relative to Tesla’s capacity planning and demand numbers once floated by Musk.

What does Musk have to say about that now? What’s the plan for turning things around - or accepting that the Cybertruck will be a niche product?

Tesla has been to the Age of EVs what General Motors was to the heyday of combustion cars.

It was inevitable that Tesla would lose share as more rivals entered the fray. (Some of those competitors, such as Rivian, are getting help from governments that want more than one EV champion.)

The question is whether Tesla could relive GM’s experience in the 1980s and early 1990s, when a run of dull, poorly executed or poorly-timed models coincided with the landing of powerful new rivals. That combination tilted the one-time King of the Auto Industry into freefall. (GM today makes good money on 16.5% of the U.S. market - but the adjustment from the days of 50% + U.S. market share was long and painful.)

Tesla’s current $1.3 trillion market cap stifles criticism, to be sure. But if the past 40 years of auto industry history have taught us anything, it is that the mighty can fall.

3-What is the real business model for robo-taxis and humanoid robots?

Elon Musk’s response to questions about the Tesla car business has been, who cars about cars? Tesla will soon become a robotics company selling driverless rides and humanoid robot laborers.

The driverless rides business so far has been a loss leader. There’s a bull case for Waymo, the U.S. leader in the space. How would Tesla close the gap profitably?

What’s the pathway to making automated cars safe on roads crowded with humans, answering the critiques of AI experts such as George Mason University’s Missy Cummings?

As for Optimus: Any orders yet?

4 - What’s happening with the launch of the updated Model Y?

Before Tesla becomes a robot company, it needs to do boring car company stuff such as execute the re-launch of its top-selling vehicle, the Model Y.

Why did Tesla decide to stop building the redesigned Model Y in Shanghai for three weeks to “upgrade” the production line? Why wasn’t the production system in order before such a crucial launch (see question #1)? BYD and other Chinese EV makers are not waiting around. They are keeping up a volley of new model launches.

5 - Speaking of Trump, what is Tesla’s plan for a world of tariffs and zero EV subsidies?

Big links in Tesla’s supply chain lie in China, just like other major automakers. That’s going to be a problem assuming President-elect Trump isn’t kidding about slapping big tariffs on Chinese imports.

Tesla earlier this year told suppliers to move production outside China ASAP.

How much will that cost? What will be the cost-per-vehicle/profit-per-vehicle impact of a less-Chinese supply chain and higher import tariffs?

How exposed is Tesla to potential Chinese retaliation - such as tariffs on goods shipped into China or bans on U.S. technology? What are the risks of non-tariff punishments, such as signaling to Chinese consumers that buying a Tesla is unpatriotic? Ask Hyundai about that.

More later….