Automakers Can't Keep Faking it in Trump's Economy

Plus, Tesla bets it all on Elon and Grosse Angst in München

Greetings from Motown!

Summer vacation time is over, and there is a lot going on in the World of Cars. I will get to Elon Musk’s “$1 trillion maybe” pay deal and highlights from the IAA Mobility auto show in Munich this week.

First, let’s talk about cars, inflation and the U.S. economy, starting with some data.

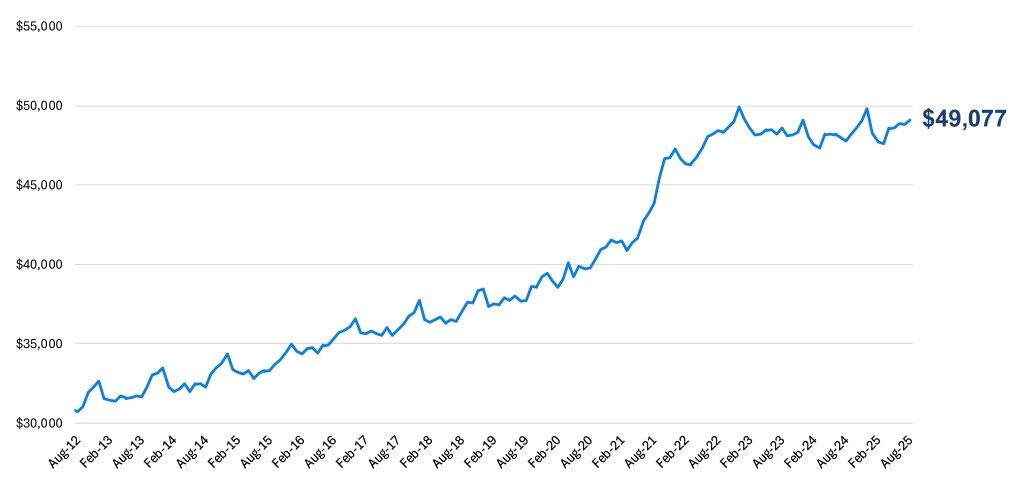

Here’s a chart of new car price trends since 2012 from Cox Automotive/Kelley Blue Book.

There are other auto price tracking tools. Here’s one from Cloud Theory via Automotive News that shows the average price of a new vehicle at $49,870.

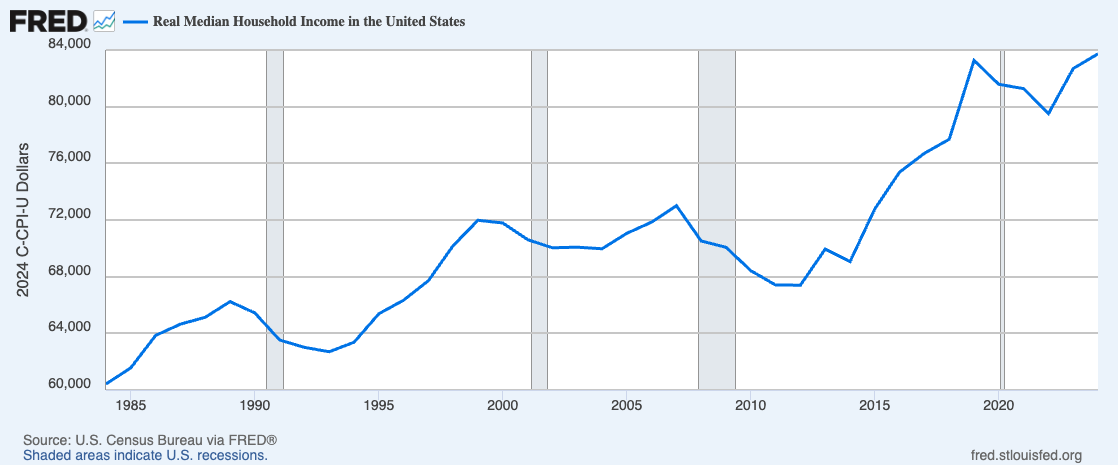

Here’s a graph of the changes in median household income in the United States since 1985:

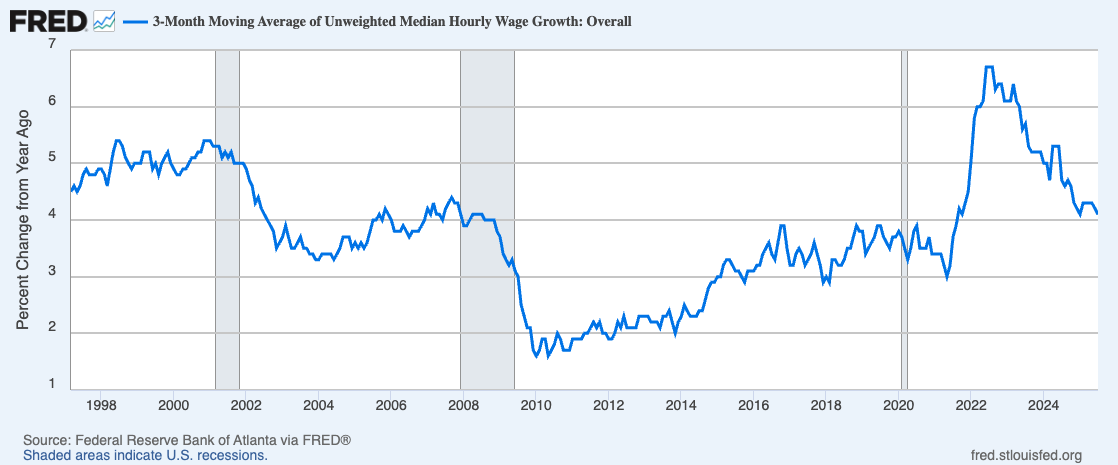

And here’s the pace of hourly wage growth since 1998.

In short, new vehicle prices are up about 23% since 2020, while median household income is more or less flat over the same period.

Hourly wages are growing - but not as fast as they were two years ago.

The latest data show the U.S. job market is weakening as companies slow down hiring. Consumer confidence in job prospects and future income is gliding down.

One way to sustain sales in this environment would be to hold prices flat and offer more discounts. But where’s the money for that? U.S. automakers paid $1.4 billion in tariffs in July - just one month, economist Patrick Anderson of Anderson Economic Group estimates. JD Power estimates border tax costs at $4,275 per vehicle.

Automakers have been careful not to jack up prices abruptly since Trump began raising import taxes in earnest last April.

But as they veer into the fourth quarter, with no significant relief in sight, automakers are confronted with a limited array of lousy choices.

Raise prices on 2026 models. KBB reports that new vehicle prices rose 2.6% in August, the fastest pace in two years.

Accept that high prices mean lower sales volume and cut production and jobs.

EVs are the canaries in the production forecast coal mine. Automakers are expecting a steep drop in demand after the Sept. 30 expiration of the $7,500 federal EV purchase subsidy. GM will cut output of two Cadillac EVs and delay hiring workers for a second shift at the factory that will build the new Chevy Bolt EV, Reuters reported.

Continue sticking shareholders and employees with tariff costs - slashing budgets and accepting lower profit margins.

Do all of the above.

Automakers will benefit from the Trump Administration’s non-enforcement of CO2 emissions and fuel economy rules. The Trump Budget’s provision allowing consumers to deduct car loan interest from their taxes could give the industry a lift - albeit a limited one.

A Fed rate cut could help. A rebound in income growth and relief from import tax cuts would help more.

Overall, the industry outlook for the rest of 2025 and into 2026 is mixed at best - as detailed by industry analyst Warren Browne in the latest Vehicle Performance Tracker, here.

Elon Musk, Trillionaire? Not so fast

Elon Musk’s $1 trillion pay deal, which you can read here, makes for great headlines that may not reflect eventual reality. Unless….

Musk can lead Tesla to an $8.5 TRILLION market cap with $400 billion in pre-tax profits (EBITDA.) That market cap is roughly twice that of Nvidia, the world’s most valuable company today.

Musk can at long last develop a succession plan.

Musk turns around Tesla’s declining sales and hits ambitious EV, robotaxi and “bots” delivery targets.

The world’s first or second wealthiest individual can refocus on Tesla as opposed to his AI venture, SpaceX, politics or whatever other squirrels cross his path.

Musk stays on the job as Tesla CEO for the next 10 years.

The Tesla board’s justification for all this comes to this: We’re screwed without Elon.

The Special Committee believes that retaining and incentivizing Mr. Musk as Chief Executive Officer at this pivotal moment is essential to Tesla’s successful transition from its role as a leader in the EV and renewable energy industries to growing into a leader in AI, robotics and related services. (Emphasis added.)

The highlighted language is one of the most explicit confirmations yet that Musk and his board have concluded Tesla cannot go much further as just an EV company.

Among the milestones he must hit are 10 Million Active FSD Subscriptions, 1 million “Bots Delivered,” and 1 million robotaxis “in commercial operation.” Musk has been promising these ambitious rollouts, and providing little evidence of delivering. (“Bots” includes the Optimus humanoid robot and any other product using artificial intelligence, Tesla’s proxy statement said.

In effect, Tesla’s board has challenged Musk to put his money where his mouth is. Musk wants 25% control of Tesla. With this deal he could get it if he makes good on what has been vaporware.

Unless… Musk engineers a consolidation of Tesla, xAI and SpaceX that accelerates the market cap of the new “Tesla” toward the $8.5 trillion target. That would make award of unearned shares “based solely on the Market Capitalization Milestones.”

German automakers strike back

Executives of Volkswagen, Mercedes and BMW convened in Munich to show off new models aimed at the Chinese brands eating their lunch. The most notable: BMW’s iX3, the first of the Neue Klasse generation of compact EVs, and Mercedes’ rival GLC, which features a new software architecture and a 39”, pillar-to-pillar dash screen.

Mercedes CEO Ola Kaellenius was upbeat, telling Reuters Mercedes would fight to preserve its premium position in China while the price war in the world’s biggest auto market rages on.

VW CEO Oliver Blume didn’t get the memo about stiff upper lips. “The party is over,” the embattled chief of both VW and Porsche told Reuters. He went on: “The (Chinese) luxury market does not exist anymore.”

Chinese automakers including BYD and Xpeng crashed the German party with announcements of more new models and more investments in EU production and engineering infrastructure. Consultant and China veteran Mike Dunne outlined the impact here.

Lightning laps

The U.S. immigration raid of a Hyundai/LG battery plant under construction in Georgia puts two Trump priorities in conflict, writes Reuters’ Robyn Mak.

Trump wants U.S. trading partners to invest huge sums to revive U.S. manufacturing. South Korea has talked about $350 billion in U.S. investment. But Trump sees aggressive enforcement of immigration law as a winning issue. South Korean companies have treated U.S. work visa rules as suggestions. They won’t anymore.

Some U.S. business groups are now urging Trump to ease up. The FT reported some companies are pausing travel to the United States for employees who are not U.S. citizens.

Ferrari launched its new, top of the line 849 Testarossa hybrid, with over 1,000 horsepower and a look that harked back to the 1980s. If you have $549,000 and an inside line with a Ferrari dealer, you might be able to get one.

More later..